Slag recycling

Iron and steel slags are by-products of steel production. These mineral raw materials mainly consist of lime silicate compounds and are classified as secondary raw materials and not as waste because of their homogeneous and advantageous properties. The following report provides an overview of the recycling quantities with current worldwide market data and trends.

1 Introduction

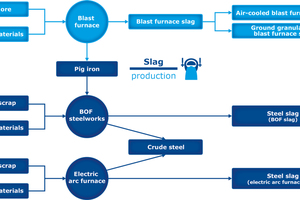

Iron and steel slags are valuable raw materials that are obtained during the pig iron and crude steel production processes. Two main production methods are involved (Fig. 1). In the iron ore-based process, pig iron is produced from oxidic iron ores in a blast furnace. In an LD oxygen converter the molten pig iron is then processed together with steel scrap into crude steel. In the purely scrap-based production variant, the raw steel is produced by recycling steel scrap in an electric arc furnace. Depending on which of these production processes is used, one speaks of blast furnace slag or steelworks slag. The terms blast furnace slag (BFS) and granulated blast furnace slag, as well as LD slag and electric furnace slag are used for finer distinctions.

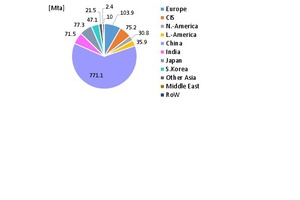

With high-quality iron ore grades with an iron content of 64 to 67 %, a blast furnace typically produces about 0.25 to 0.30 t of slag per t of pig iron. In the case of inferior grade ores below 60 %, the amount of slag is typically 0.35 to 0.50 slag/t of pig iron [1]. In 2018, approximately 1247 million tonnes (Mta) of pig iron were produced worldwide, compared to 1212 Mta in 2017, leading to the production of approximately 330 to 375 Mta of blast furnace slag (BFS). Fig. 2 shows the global pig iron production output in 2018. Europe accounts for 8.3 % (103.9 Mta) of production, North America 2.5 % (30.8 Mta). China alone accounts for 61.9 % (771.1 Mta), Japan produces 6.2 % (77.3 Mta) and India 5.7 % (71.5 Mta). The regions with the lowest production volumes include the Middle East (0.2 %) and Africa (0.4 %).

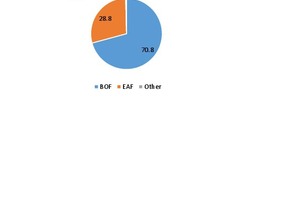

According to the World Steel Association, roughly 0.126 slag/t of crude steel are produced using the BOF process (Basic Oxygen Furnace), and 0.169 slag/t of crude steel using the EAF process (Electric Arc Furnace). Global crude steel production in 2018 was approximately 1807.1 Mta. 70.8 % of the current crude steel production is accounted for by the BOF process, 28.8 % by the EAF process (Fig. 3) and only 0.4 % by other processes such as the Siemens Martin process. Derived from these figures, the annual quantities of steelworks slag amount to a total of 250 Mta, of which around 65 % are BOF or LD slags and 35 % EAF slags. In total, there are around 600 Mta of slags from the steel industry worldwide, of which 58 % are BFS and 42 % are steelworks slags.

2 Slag recycling and the circular economy

Iron and steel slags are already making a significant contribution to the circular economy in numerous countries. Almost all of the slag from the steel industry in those countries is used for the manufacturing of high-quality products for the cement and building materials industries, aggregates for road construction and fertilizers. Only small quantities end up in waste disposal sites or are used for landfilling. Unfortunately, this is not the case everywhere in the world, partly because there is a lack of suitable rules and regulations or because in many countries little importance is placed on resource conservation.

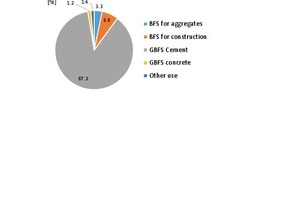

Germany is one of the model countries in slag recycling. In 2018, the country produced 27.271 Mta of pig iron and a total of 42.435 Mta of crude steel. This corresponds to 30 % of the total pig iron production and 25.3 % of crude steel production in the EU28. As a result, Germany produced 13.18 Mta of iron and steel slag, of which 7.79 Mta were blast furnace slags and 5.39 Mta were steelworks slags. Fig. 4a shows how the blast furnace slags were utilized. The quantity utilized was 8.83 Mta, since a further 1.04 Mta became available through the reduction of inventory stocks. The majority (83.7 %) was granulated blast furnace slag (slag sand) used for cement production, while a further 1.2 % of slag sand went into the production of concrete. The remaining quantities went as BFS into the production of aggregates or other building materials.

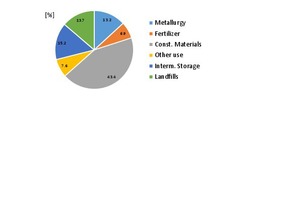

Of the 5.39 Mta of steelworks slag in Germany, 59.4 % was BOF slag, 30.2 % was EAF steelworks slag and 10.4 % was slag from special processes. Fig. 4b shows the ways in which these slags are utilized. 3.83 Mta or 71.1 % of these slags were utilized, while 15.2 % went to interim storage and 13.7 % to disposal sites or landfills. With 2.43 Mta or approx. 61 %, utilization as a building material (road construction, earthworks, hydraulic engineering) accounts for the largest amount, followed by recycling in metallurgical processes with 18.5 % and use as fertilizer with 9.7 %.

The greatest economic benefit is gained by the use of granulated blast furnace slag in the cement industry for the production of Portland blast furnace cements and other Portland blended cements. When the liquid (molten) slag is quenched with water in a granulation plant (Fig. 5), a glassy and granular product is created, which must subsequently be ground to produce a fine powder, which is used as a clinker substitute. Ground granulated blast furnace slag (GGBFS) has similar cement-like properties to Portland cement. The glass content of GGBFS varies between 60 % and 100 % by volume, depending on the granulation process. For many applications, blast furnace slag cements have even better properties than conventional Portland cements.

3 Global market data

The utilization rates for iron and steel slags are very different from region to region or country to country. The leading regions and countries of the world are examined in more detail below. Strictly speaking, the term recycling only applies to recycling within the steel industry.

3.1 Europe

In Europe, EUROSLAG records the production and slag recovery quantities every two years. The data for the EU28 are derived from the reports published by the 19 most important countries and data from the World Steel Association for pig iron production. The result for 2018 comes to 20.7 Mta of blast furnace slag and 16.3 Mta of steelworks slag or 37.0 Mta of total steel and iron works slag. In 2016, the figures were still 24.6 Mta of blast furnace slag and 18.4 Mta of steelworks slag. The production of blast furnace slag has thus fallen by 15.9 % in the past two years, while that of steelworks slag has dropped by 11.4 %. In that period, pig iron production only decreased by 2.5 % in the EU28, and crude steel production even increased from 162 Mta to 167.6 Mta and is currently (2019) at 159.4 Mta.

The Waste Framework Directive 2008/98/EC also regulated the recycling of iron and steel slags. Fig. 6 shows the recycling of blast furnace slag for 2018. The production volume was 20.7 Mta, of which 86.0 % was sand slag from slag granulation and 14 % was air-cooled BFS. From interim storage, 1.5 Mta was added to the production quantities, so that a total of 22.3 Mta of BFS was used in 2018. 17.9 Mta went into the production of cement and concrete, 4.0 Mta went into road construction and 0.4 Mta into other uses. Granulated blast furnace slag is primarily used in Europe for the production of Portland blast furnace cement. The necessary grinding of the slag to the finenesses required for cement is now mostly performed in vertical mills (Fig. 7), which achieve throughputs of over 100 t/h [2].

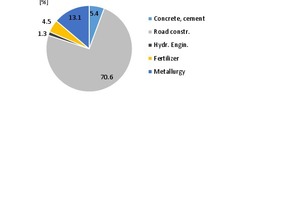

Of the 16.3 Mta of steelworks slag in Europe, 52.3 % are BOF slag, 34.9 % are EAF slag and 12.6 % are other types of steelworks slag. Of this amount, 11.8 Mta or 72.4 % was recovered, 15.3 % went to interim storage and 12.3 % to dumps and landfills. The recovery or recycling quantities are shown in Fig. 8. With 70.6 %, the greater proportion was used as aggregate in the production of concrete [3] instead of gravel and grit. The quantities used in cement production are negligible compared to the quantities used in concrete production. Only 1.3 % of the produced slag were used in road construction, while 4.5 % were used in hydraulic engineering. A relatively large amount of 13.1 % was used as fertilizer, and the remaining 10.5 % was recycled in metallurgical processes or used in other applications.

3.2 USA

In the USA, about 17.0 Mta of iron and steel slag was produced in 2019, after 15.7 Mta in 2016. The production output of pig iron and crude steel has recently increased slightly by around 2 %. No slag recovery data is available for 2019, but estimates from the US Geological Survey (USGS) assume that the quantity recovered will comprise approximately 50 % blast furnace slag and 50 % steelworks slag with a merchandise value of US$ 470 million. Blast furnace slag accounts for 88 % of the commercial value. In the USA, the slag is processed at a total of 129 locations by 28 companies. This also includes companies that import or grind and export granulated blast furnace slag. The import quantities for slag (mostly granulated blast furnace slag) in the USA were 2.3 Mta in 2019 after 2.0 Mta in 2016.

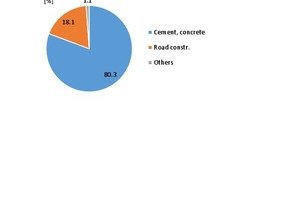

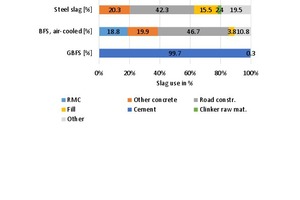

In 2016, 8.2 Mta of blast furnace slag was produced, of which only 2.9 Mta (35.4 %) was granulated slag and 5.3 Mta (64.6 %) was air-cooled blast furnace slag. In addition, 7.4 Mta of steelworks slag was produced. Fig. 9 shows the amounts recovered. It can be seen that only granulated blast furnace slag (GBFS) can be used as a cement additive. For ready-mixed concrete and other types of concrete, both normal blast furnace slag and steelworks slag are used with respective totals of 38.7 % and 20.3 %. However, these slags are mainly used for road construction. Steelworks slag is also suitable as a filler and as a raw material for clinker production. The average prices obtained in 2016 for slag are also of interest: the highest price of 89.2 US$/t was achieved for GBFS, while air-cooled blast furnace slag brought 8.5 US$/t and steelworks slag 5.9 US$/t.

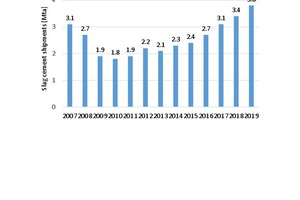

A market for slag cement has developed in the USA. Fig. 10 shows the market trend since 2007 according to data from the Slag Cement Association (SCA). The market peaked at 3.819 Mta in 2019 having increased practically continuously since 2010, after the end of the economic crisis. The increase in production volumes in 2019 was 10.8 % over the previous year, after an 11 % increase in 2018. The results show that slag cements are in vogue in the USA and that the demand cannot be met by the existing granulation plants alone. That is why around 2.3 Mta of ground granulated blast furnace slag was imported in 2019. Companies that use slag cement in the USA emphasize the CO2 saving effect compared to conventional OPC (Ordinary Portland Cement).

3.3 Japan

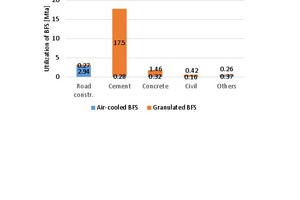

The use of iron and steel slag has a long tradition in Japan [4]. However, the produced quantity of blast furnace slag decreased from 25.4 Mta in 2007 to 23.0 Mta in 2017, but the proportion of granulated slag rose slightly from 82.6 % to 84.4 %. By international comparison, these figures give Japan a leading position. The recycling quantities of the blast furnace slags are shown in Fig. 11. First of all, it is very noteworthy that the slag recovery rate is 100 %. Amounts that are simply dumped in other countries are used for soil improvement in Japan. 88 % or 17.5 Mta of the country‘s granulated blast furnace slag is used in cement production, 7.3 % is used in the production of concrete and 2.1 % in the construction industry. 1.3 % goes to unspecified applications.

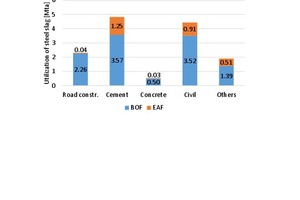

The amount of steelworks slags in Japan has decreased from 15.2 Mta in 2007 to 13.7 Mta, which of course has to do with the decrease in crude steel production from 120.2 to 104.7 Mta in this period. The shares of BOF steelworks slag compared to EAF steelworks slag increased in Japan from 75.9 % to 79.9 % in the same period. Fig. 12 shows the recovery quantities for 2017. The steelworks slags were almost 100 % recovered. The large quantities sold to the cement industry are interesting. However, unlike GBFS, steelworks slags are not used as a cement additive, but as an alternative raw material for clinker production. The likewise large quantities of 3.52 Mta for BOF slag and 0.91 Mta for EAF slag relate to their use as a filler in the construction industry.

3.4 Other countries

In China, the utilization of iron and steel slags has increased significantly in recent years. In 2018, the country produced about 225 Mta of blast furnace slag and about 122 Mta of steelworks slag after 200 Mta and 81.5 Mta respectively in 2010. There are still big differences in the utilization of the different slags. The number of granulation plants for blast furnace slag has grown strongly. Since around 2000, the most important Chinese steel producers have been investing in granulation and grinding plants for blast furnace slag. It is currently estimated that 95 % of the blast furnace slag is granulated and used entirely in the cement and concrete industry. Almost 70 % of the steelworks slag goes to dumps and landfills [5] (Fig. 13). The most important types of utilization with 9.3 % are the application as raw material for clinker production and recycling within the metal industry.

In Brazil, by-products from the steel industry consist of 42 % blast furnace slag, 27 % steelworks slag and 31 % other by-products such as dusts, sludges, etc., according to figures from the Brazil Steel Institute for 2017. 92 % of the approximately 8.8 Mta of blast furnace slag was recycled in 2017, of which 99 % went to cement production. Of the approximately 5.6 Mta of steelworks slags, 36 % were recovered in 2017 and 23 % were recycled within the steel industry. The recovered quantities went almost entirely to road construction. Unfortunately, the Steel Institute has no information on the number of granulation plants for blast furnace slag in Brazil. However, it is assumed that almost every blast furnace is equipped with such a plant, since long-standing supply contracts exist between the steel industry and the cement companies.

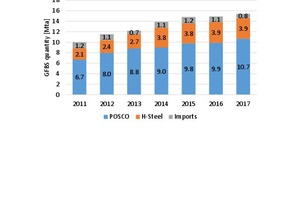

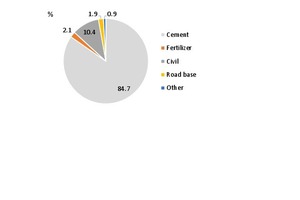

In South Korea, the production of blast furnace slag grew significantly in the years leading up to 2017. In 2019, the industry came under pressure due to pollution problems, and steel production fell by 1.5 % compared to the previous year. Fig. 14 shows the production data for blast furnace slag as well as the import figures. There are only two steel companies, POSCO and Hyundai, with POSCO having a market share of 76 % in blast furnace slag production in 2011 and a share of 73.3 % in 2017. Slag imports accounted for 5.2 % of the total in 2017. The 2015 recovery quantities for blast furnace slag are shown in Fig. 15. Granulated slag makes up 86 %, of which almost the entire amount is used in the cement industry. The fields of application of the air-cooled slag are mainly in road construction and other uses in the construction industry.

4 Trends in slag recycling

The three most important trends for slag recycling relate to further investments in granulation plants for blast furnace slag, the increase in slag trading with separate slag grinding plants and the increasing use of steelworks slag as an additive for the concrete industry. There are various processes on the market for the granulation of blast furnace slag. The most important process is cooling in a water bath. The most common methods are the RASA system from Rasa Corporation, the INBA system (Fig. 16) from Paul Wurth, a company of the SMS group, and the IJ GRAN system from Danieli-Corus. Paul Wurth already has more than 300 such systems in three process variants in operation worldwide. Currently, dry granulation processes with a heat recovery system such as those from CSIRO or Primetals Technologies are also in development.

The increasing global and local imbalances in slag production, slag recovery and recycling have led to a rise in global trade flows. According to the World Steel Association, about 25 Mta of slag is traded across national borders worldwide, 12 Mta alone concern exports from Japan and 5 to 6 Mta relate to exports from China. An estimated further 50 to 60 Mta of slag is transported inside countries over distances of several hundred kilometres. The cheapest means of transport is by water (Fig. 17). As a result, however, new grinding and blending plants (Fig. 18) have also been built near blast furnace systems all around the world. From an international perspective, it is striking that separate grinding plants for the utilization of slag in cement production are being built worldwide for grinding imported clinker and slag. Because of the CO2 issue, this trend can also be expected to spread further in Europe.

Steelworks slag is increasingly finding use as a substitute for gravel and grit in concrete production. One of the reasons is depletion of the natural deposits of sand, gravel and grit [6]. With prices of less than 7 US$/t, it is cheaper to use slag than to produce gravel and grit in quarries. In some cases, the sources of slag are also located closer to the consumer markets, so that transport costs can be saved. The only disadvantage is the lack of official permission for slag recycling in some countries.

5 Prospects

According to the International Energy Agency (IEA), the global steel industry is responsible for around 1/5 of industrial energy consumption and ¼ of industrial CO2 emissions. Despite the global CO2 reduction targets, the IEA assumes that by 2050 worldwide steel consumption will increase by 30 % compared to today, with an increase of 400 % being forecast for individual countries such as India [7]. Global slag production will continue to increase accordingly, even if individual technologies such as EAF steel production have declined in percentage terms by almost 10 % compared to BOF processes in the past 15 years, thereby reducing the percentage quantities of the produced slag.

![13 Recycling of steelworks slag in China in 2017, [5]](https://www.recovery-worldwide.com/imgs/1/5/6/0/3/3/9/tok_a0c417b02708c73160bc0ecb2c178db5/w300_h200_x297_y421_13_Stahlwerksschlacke-750cc604840b6315.jpeg)