The limitations of textile recycling

The global consumption of clothing and textiles is increasing significantly faster than the population is growing. Clothing has become a disposable commodity. With less than 1 % recycling, we would be better talking about a linear rather than a circular economy. In this paper, current figures and facts are provided while the limitations but also promising opportunities for textile recycling are presented.

1 Introduction

Fashion and models, who isn’t fascinated by this beautiful world? We seldom get to see the dark sides, but these are alarming. Less than 1 % of clothing manufactured worldwide is recycled into new fibres for the clothing industry (Fig. 1). This is the finding of a study by the renowned Ellen MacArthur Foundation for the year 2015 [1]. Of the estimated 53 million tonnes (Mta) of clothing manufactured annually, 73 % end up on landfills or are incinerated. 12 % are downcycled to other lower-quality products like insulating materials or cleaning cloths. Another 12 % is lost in manufacture as offcuts or destroyed as unsellable surplus stock. 0.5 Mta or almost 1 % alone of the volume finds its way as microplastic into waters as a result of the washing of synthetic textiles.

According to estimates, 99 Mta textiles and clothing are consumed worldwide. By the year 2050, 22 Mta new microplastic will pollute our oceans, the share of the textile industry in global CO2 emissions will rise from 2 % to 26 %, and instead of 98 Mta crude oil in 2015, around 300 Mta will be consumed by the textiles industry. What makes the issue even more alarming are the environmental pollution and the resources consumption associated now and in the future with the textiles industry. Cotton clothing, which, after all, is regarded as particularly natural and healthy, currently needs for cotton farming worldwide 0.2 Mta pesticides and 8 Mta fertilizer. In India, already 50 % of all pesticides are used for cotton production. For 1 kg cotton or one pair of jeans, an average of 20 000 l water are needed. Textile production needs a total of 4 % of global freshwater consumption.

2 Changes in consumer behaviour

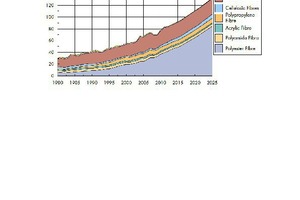

The global consumption of textiles is rising faster than the growth of the population. Fig. 2 shows the development of global fibre production since the year 1980. The demand will increase from around 30 Mta in 1980 to 130 Mta in 2025. That corresponds to growth of over 400 % or an average annual growth rate of 4.3 %. In the same period, the global population has been growing by only 1.7 %. What aggravates the situation is the rapid increase in the demand for clothing over the last ten years. Almost 95 % of the future growth will be in the form of polyester while a small part will consist of polypropylene and cellulose fibres. Volumes of cotton will remain just about constant, those of wool will even decrease. Currently, around 100 billion items of clothing are manufactured annually worldwide, more than needed.

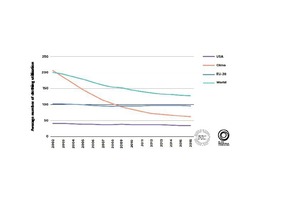

Fashion is short-lived. Up to 24 new collections are launched by leading fashion houses on the market every year. T-shirts for 3 €, jeans for 11 €, the cheap-sell concept of the fashion branch is working. Fashion in the western world means fast fashion and cut-price offers. Worldwide, the usage of an item of clothing has decreased by 36 % over the last 15 years (Fig. 3). In China, for example, an item of clothing is no longer worn 200 times, but just 62 times. In the USA, this value already used to be under 50 but has since been reduced to around 40 times [1]. Among young customers, fashion has become a daily consumer article in some cases. Chain stores like Primark are profiting from this boom. The flip side of the coin: fashion degenerates to throwaway items.

In the European Union (EU), an average of 5 % of the expenditure of private households goes on shoes and clothes. Over 90 % of these are imported from countries outside Europe, compared with 33 % in the year 2004. In 2016, according to EU estimates, 6.4 Mta new clothes or around 12.7 kg per consumer are acquired. The European Environment Agency (EEA) estimates that clothing consumption in EU has increased by 40 % from 1996 to 2012 More than 30 % of the clothing was no longer worn for more than one year. In the EU, cotton still plays the leading role with 43 % of materials according to a report by the European Clothing Action Plan (ECAP), polyester accounts for 16 %, other synthetic materials like polyamide, nylon and acrylic account for 20 %, wool for 9 %, silk/linen for 3 % and other materials (primarily viscose) 9 %.

Worldwide and especially in countries with high purchasing power, it can be observed that the usage phases for items of clothing are now becoming so short on account of the fast fashion trends, the price decline, poorer qualities and new wearing habits that clothes can be described as throwaway items. The reasons for the disposal of clothes are diverse. In a household survey conducted in Great Britain in 2016, people said that they sort out clothing because in 42 % of cases it no longer fits, in 26 % of cases it is simply unfashionable, in 19 % of cases it is worn out or damaged, in 7 % of cases is no longer used and in 6 % for other reasons, because otherwise, for instance, there is no longer space for any new things in their wardrobe. Interesting in this connection is also the trend towards disposable clothing, e.g. protective clothing but also in fashion.

3 Recycling strategies for textiles

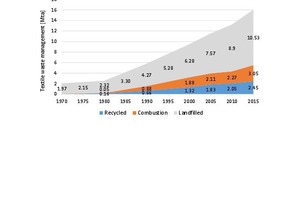

Around 95 % of end-of-use (EoU) textiles and items of clothing can be recycled. A lot of what lands in the collection containers is previously washed again with the idea that the clothes will land on the second-hand market. But reality perhaps looks different. In the USA, for example, according to current figures from the Environmental Protection Agency (EPA) for 2015, 16 Mta textiles are sorted out and disposed of. An average American arrives at 36.3 kg EoU textiles per year, this is the top value worldwide. But only a small part is recycled (Fig, 4). While the total disposal levels have risen from 2.04 Mta in 1970 to 16.03 Mta in 2015, the recycling levels were only 0.005 Mta (3 %) in 1970 and 2.45 Mta (15 %) in 2015. The landfilled levels, on the other hand, have risen from 1.97 Mta to 10.53 Mta.

In the EU, you look in vain for publicly accessible figures for EoU textile and clothing waste. In the EU statistics, these are included in the household and commercial waste, but no further specifications are given. Estimates assume that these add up to 16 Mta. The collected quantities for clothing and other home textiles in the EU are very different from country to country in the EU and extend from below 10 % up to 75 %. Correspondingly, the quantities labelled as waste vary. Of the collected quantities that do not go into the waste market, around a half go to re-use or the second-hand market while the other half goes into processing and further processing to lower-quality products (insulating materials, cleaning cloths, etc.) or thermal utilization (waste-to-heat recycling).

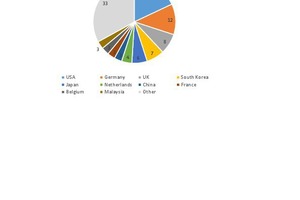

Fig. 5 shows the most important export countries for second-hand clothes. The TOP 10 is headed by the USA with 18-% market share, followed by Germany with 12 % and Great Britain with 8 %. The EU countries add up to a total 40-% market share, South Korea has a 7-% market share, Japan 6 % and China only 3 %. Ever more countries in Eastern Africa like Ethiopia, Uganda, Tanzania and Ruanda as well as India are resisting trade with second-hand clothing because this blocks the development of the domestic textile industry. Second-hand clothing and used shoes were to be banned from the markets by 2019, but the USA intervened and threatened to exclude the countries in question from the AGOA economic agreement. After agreement with the heads of state of the countries, the import ban has been dismissed for now.

It is, however, expected that in the medium term an import ban will be introduced in several countries. For Europe, this means that used clothes containers and warehouses will continue to overflow just as they have in recent years. In addition, the situation in Europe is aggravated because of the Recycling Act and Waste Directive, which state that the share of landfilled waste in the countries should not exceed 10 % by 2035. Correspondingly, all market stakeholders and consumers have to abide by the five-tier waste hierarchy:

1. Avoidance (using less, high-quality textiles, repairs)

2. Preparation for re-use (checking, cleaning, sorting)

3. Recycling (material processing)

4. Other recovery (waste to energy, etc.)

5. Disposal (different practices in the countries)

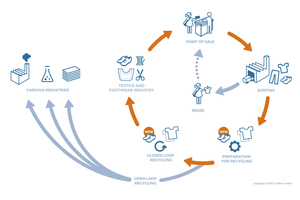

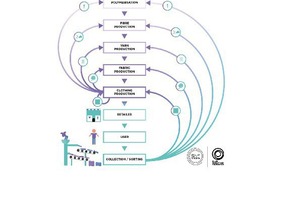

Clothes and textiles should be recycled on different levels to guarantee optimum material use (Fig. 6). First, it should be noted that selling on the second-hand market is not a part of recycling, but should be classed as re-use [1]. Recycling begins with the use of materials for new items of clothing. This is termed re-manufacturing. Here, numerous initiatives have been launched by the large fashion companies (Fig. 7). The next level is the recovery of yarns, which is limited to relatively little clothing or waste materials. For the recycling of fibres, the materials have to be sorted in respect of their material properties and colours. In polymerization, the fibres are ultimately dissolved, the chemical structure, however, is preserved A differentiation is made between polymerization by means of mechanical or chemical recycling.

4 Facts and figures

4.1 Worldwide

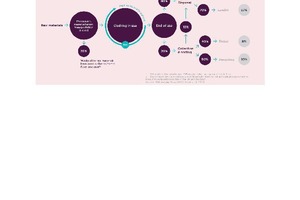

Only estimates are available for global figures on the re-use of textiles and clothes. In the “Pulse of The Fashion Industry” report [2], currently annual quantities of 99 Mta of textiles and clothes are assumed as well as 92 Mta used textiles and clothes for recycling and disposal. For the year 2015, RESYNTEX reports figures of 75 Mta EoU textiles worldwide, 20 % of which or 60 Mta are landfilled or incinerated [3]. Of the utilized textiles, 60 % are re-used as second-hand products and 40 % go into recycling (Fig. 8). Of the second-hand products, however, only 10 % are in good condition, of the 40 % recycled textiles, 15 % are downcycled to cleaning cloths, 14 % to fibres, 8 % to other uses while 3 % are disposed of as waste.

4.2 Europewide

For Europe, again, only estimated values are available. One estimation by GFA (Global Fashion Agenda) and BCG (Boston Consulting Group) comes to the result that the used textile market in 2015 had a value of € 4 bill. compared to € 165 bill. sales of the textiles and clothing industry. Ultimately, only at total of 18 % of clothing is re-used or recycled (Fig. 9). 54 % of available clothing is sorted out and disposed of every year as EoU. Of this, 20 % goes into collection and sorting and 80 % ! is disposed of as waste. 70 % of this clothing waste ends up on landfills and 30 % to is incinerated. Of the sorted quantities, another 10 % go into the waste, 40 % are re-used in the second-hand market and 50 % are recycled, although the main part is downcycled to lower-quality ware (cleaning cloths, insulating material, etc.).

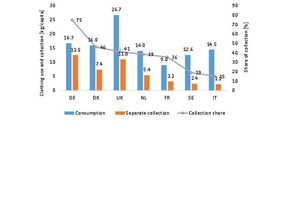

Fig. 10 shows for selected countries in the EU the specific clothing consumption and the specific clothing collection levels in kg per capita [3]. The comparative periods are very different with 2010 (UK) and 2016 (FR). Great Britain and Germany arrive at the largest absolute and relative clothing consumption quantities with 1.693 Mta and 1.347 Mta or 26.7 kg per capita and 16.7 kg per capita, respectively. The lowest relative consumption quantities are reported for France (9 kg per capita) and Sweden (12.6 kg per capita). With the collective quantities, Germany and Great Britain have with 12.5 kg per capita and 11.0 kg per capita their nose ahead, at the bottom of the rankings is Italy with 2.2 kg per capita. For the collection rates derived from this, Germany is well ahead with 75 % – in front of Denmark (46 %) and Great Britain (41 %). Italy, on the other hand, achieves just 15 %.

The textile and clothing waste quantities in the EU28 were reduced from 4.4 Mta in the year 2004 to 3.0 Mta in the year 2012. The specific quantities fell from 8 kg per capita to 6 kg per capita or by 25 % (Fig. 11). In most countries, especially in Southern and Eastern Europe, as a result of higher collection and re-use quantities, the per capita waste quantities were reduced drastically. In the two countries with the largest consumption countries, Great Britain and Germany, the waste quantities increased from 9 to19 kg per capita and from 2 to 4 kg per capita, which is associated with percentage increases of 375 % or 100 %. The reason for these increases are the increasing throwaway trends with the relatively high specific collection quantities at the same time.

4.3 Germany

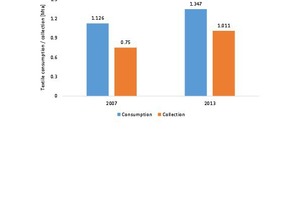

The latest study on textile recycling available for Germany is from the year 2015 with base data for 2007 and 2013 [4]. The study was compiled by the Department of Processing and Recycling at the RWTH University of Aachen as commissioned by the Textile Recycling Division (FTR) of Germany’s Federal Association of Secondary Resources and Disposal (bvse). The most important data from this study are shown in Table 1. According to this, the consumption of home textiles and clothing in Germany has increased by 20 % from 1.126 Mta in the year 2007 to 1.347 Mta, while the collected volume has grown by 35 % from 0.75 Mta to 1.011 Mta (Fig. 12). The largest growth driver in collection is container collection.

From 2007 to 2013, re-use (second-hand) has increased significantly from 0.323 Mta to 0.546 Mta and further use (cleaning cloths) has increased from 0.120 Mta to 0.212 Mta, whereas recycling (material and thermal) with 0.233 Mta has remained constant. In re-use, the problem already resulted back in 2013 that no buyer could be found for 12 % ware, and instead of 0.667 Mta, only 0.546 Mta could be sent to re-use. According to current information from the bvse, the situation has deteriorated in recent years as the fashion industry is throwing increasingly lower quality material mixes onto the market with frequently changing collections. For used clothes, a price drop from € 0.45/kg to below € 0.35/kg can be established. Experts are talking about stagnating sales and full warehouses.

5 Technology approaches

In textile recycling, the saying goes “It’s always good enough for cleaning cloths”. But recycling fibres to a high-quality product is difficult and particularly expensive. In Fig. 13, the most important recycling possibilities are shown schematically. Every form of recycling begins with sorting. Then the materials are processed depending on whether a “closed-loop recycling” is to take place, i.e. with the materials being used in the textile industry or whether only an “open-loop recycling” is possible. i.e. with the materials being used in other industries. One of the oldest techniques is the supply of paper mills with textile raw materials. However, regenerated wool factories no longer play any role in raw material supply to the paper industry while cotton, hemp and flax are only used for a few special papers.

The challenges today especially in significantly increasing closed loop recycling. The I:CO Take-back System from I:Collect is regarded as one feasible solution. The company based in Ahrensburg in Schleswig-Holstein, Northern Germany, is a global service-provider for in-store collection, re-use and recycling of used textiles and shoes. In its comprehensive form, the I:CO take-back system is unique in the textiles industry worldwide, and following its market launch in 2009 has already been successful with many companies in numerous countries. The partners include companies like Adidas, C&A, H&M, Levi’s and Timberland. H&M has, for example, increased its collection levels (Fig. 14) since 2012 to over 20 000 t or a recycling share of 1.4 %. For the year 2020, 25 000 t is targeted. The customers receive an incentive to return old clothing to the shops.

I:Collect and its processing partner SOEK are responsible for the logistics, sorting and feed of the returned wares to various cycles. The company operates a modern sorting and processing plant for 300 tonnes per day in Bitterfeld-Wolfen in Saxony-Anhalt. Around 70 % of the materials go to recycling, 15 % are processed to cleaning cloths, and 15 % of old textiles and shoes, which can’t be sold for quality reasons, are processed to diverse secondary resources (Fig. 15). In the recycling plant, annually in 24/7 operation, used textiles are mechanically shredded to selected secondary resources (shredded mixed fibres) and, for example, recycled to industrial fleece or insulating material. Shoes are taken apart into their original components like rubber, leather and textile and then re-used as secondary resources.

The Swedish company, RE:newcell, is going a bit further still. There, clothing with a high cellulose content (cotton and viscose) are recycled. At its plant in Kristinehamn (Fig. 16), 225 km west of Stockholm, 7000 t of biodegradable cellulose are produced. The items of clothing produced from this are impressive (Fig. 17). The processing of the clothes includes shredding, the removal of unwanted materials (buttons, zips, studs), decoloration, and the subsequent chemical recovery of cellulose. The production process completely with used clothing waste is more cost-efficient compared to cellulose extraction from wood fibres, but does have, in contrast to large plants, disadvantages in the economy of scale.

6 Outlook

I:CO and RE:newcell are only examples of what is possible today technically and economically in the recycling of textiles. The examples could go on in a long list. HKRITA, a research institute in Hong Kong is working on a solution for the recycling of mixed fabrics with an innovative hydrothermal process. The London-based company Worn Again Technologies is working on a pioneering process for the processing of mixed cotton/polyesters. Or take the activities of the US American Aquafil for regeneration of nylon. Companies that are addressing other innovative textile technologies for more sustainability are, for example, the Swiss Schoeller Textil AG or the Austrian Lenzing Group. Yet it should not be ignored that that up to now less than 1 % textile fibres are recycled in a “closed loop” and as such the road to a recycling economy remains a long one.

![Globale Verwertung von Textilien [3]](https://www.recovery-worldwide.com/imgs/1/4/7/3/6/4/9/tok_c3e8cade310f9075c0f7be68f5bc2396/w300_h200_x297_y421_Global_use_of_textiles-a98064426cd0379c.jpeg)

![Textil- und Bekleidungsabfallmengen in Ländern der EU [4]](https://www.recovery-worldwide.com/imgs/1/4/7/3/6/4/9/tok_3c8168d9feddb3d6aace5483c3a3e5b4/w300_h200_x297_y421_Quantities_of_textile_and_clothing_waste_in_the_EU_countries-2ac3c75921dfe31c.jpeg)