Advanced Recycling on the rise – rapid growth in capacities at global and European level

29.02.2024The update and expansion of the nova-Institute's report "Mapping of advanced plastic waste recycling technologies and their global capacities" provides a detailed insight into technological advances, identifies key players in the field and describes the current state of advanced recycling in Europe and worldwide.

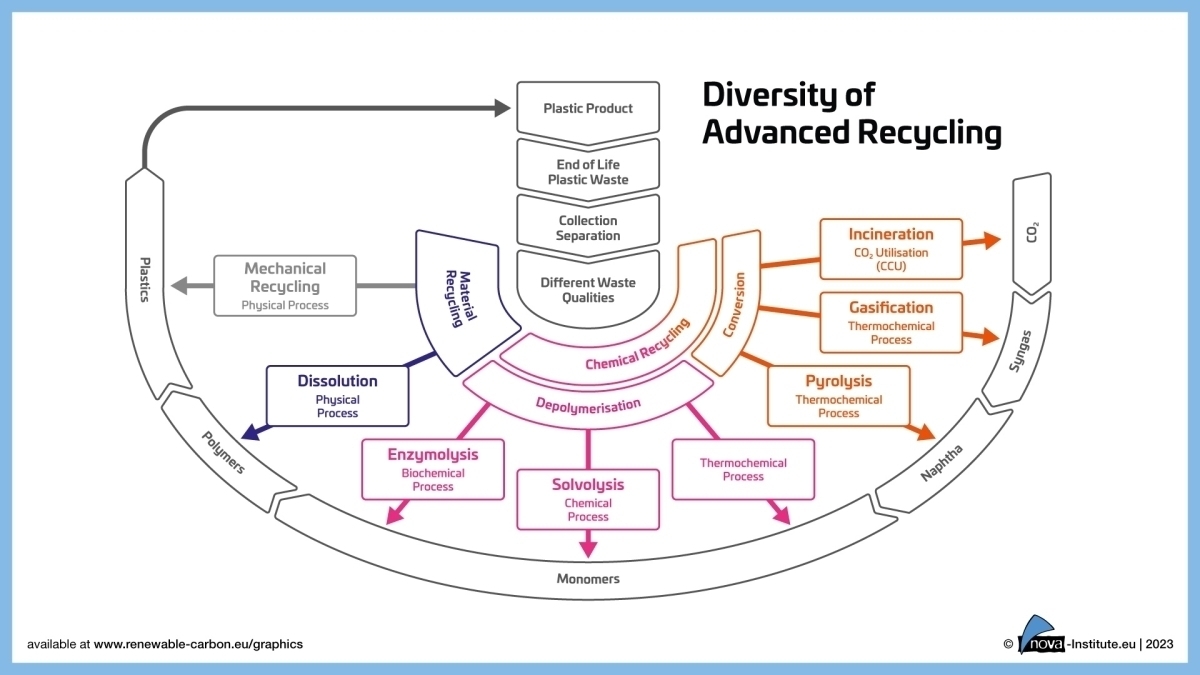

Overview: Diversity of Advanced Recycling Technologies

Overview: Diversity of Advanced Recycling Technologies

© nova-Institut

Advanced recycling technologies are developing at a fast pace, with new players constantly appearing on the market, from start-ups to chemistry giants and everything in between. New plants are being built, new capacities are being achieved, and new partnerships are established. Due to these dynamic developments, it is difficult to keep track of everything. The report “Mapping of advanced plastic waste recycling technologies and their global capacities” aims to clear up this jungle of information providing a structured overview and in-depth insight. It focusses on profiling more than 130 available technologies and providers of advanced and especially chemical recycling solutions as well as pre- and post-processing technologies. New company profiles were added and all profiles were revised and updated to the year 2023. For the first time a comprehensive evaluation of the global input and output capacities was carried out for which more than 340 planned as well as installed and operating plants including their specific product yields were mapped. This detailed report provides a unique insight into the current landscape of advanced recycling and emphasises its rapidly growing importance on a global and European level.

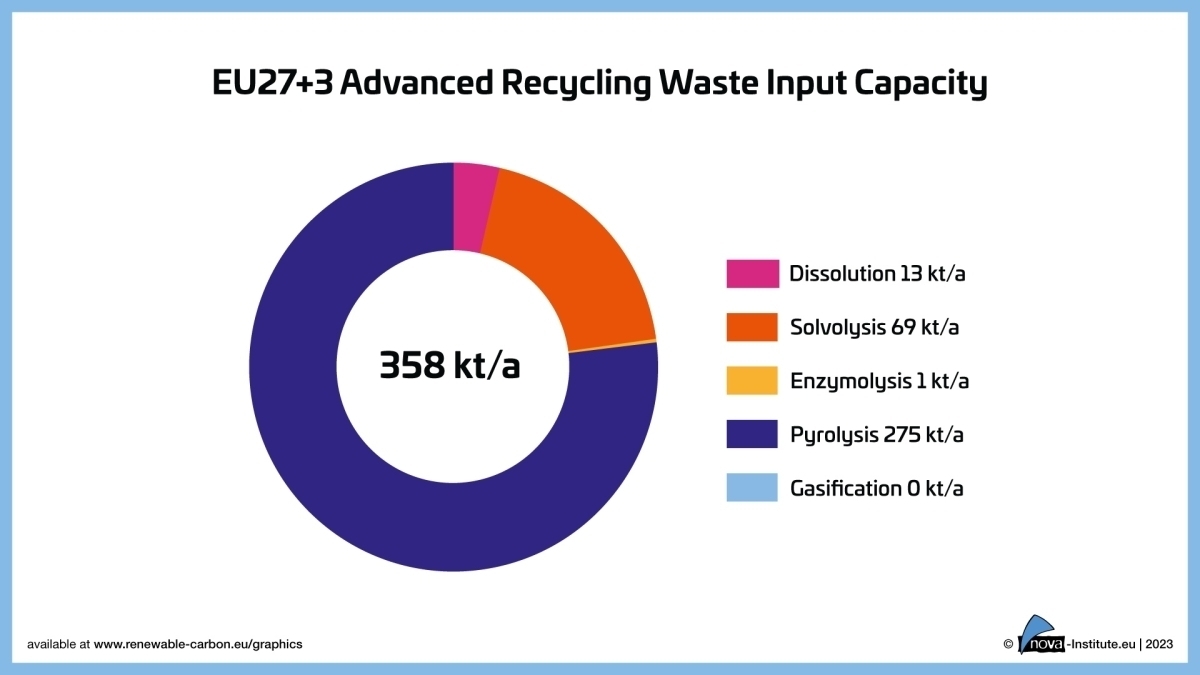

EU27+3 Advanced Recycling Waste Input Capacity

EU27+3 Advanced Recycling Waste Input Capacity

© nova-Institut

Advanced recycling technologies to complement mechanical recycling

Besides conventional mechanical recycling and with regard to recent discussions on the improvement of recycling rates, a wide spectrum of advanced recycling technologies is moving into focus. Mechanical recycling alone only offers limited options, its further development as well as the development of new advanced technologies will therefore continue which highlights the need for a large spectrum of different recycling solutions that complement each other. With mechanical recycling, contaminations cannot be removed from the plastics waste streams, which is why mechanically recycled plastics are not approved for food contact applications. Furthermore, if a plastic is repeatedly mechanically recycled, the material loses its performance-quality and characteristics depending on the number of recycling loops and the particular polymer. These issues can therefore not be solved with mechanical recycling alone. An even greater limitation is set by the usable raw materials. In cases of mixed plastic waste or mixed waste containing various plastics and organic waste, mechanical recycling is no option, or allows only partial solutions with considerable effort of pre-treatment. In consequence, these waste streams mostly end up in landfill or incineration instead of further processing them into a new feedstock. This is why advanced recycling technologies are crucial for the circular economy.

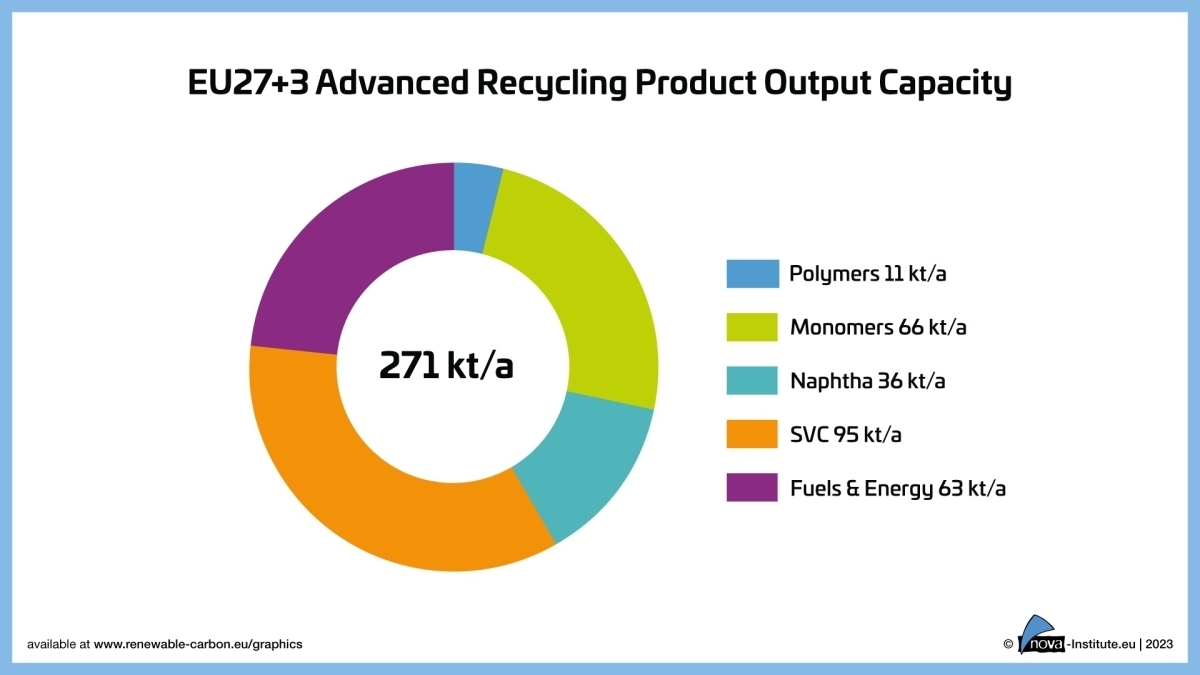

EU27+3 Advanced Recycling Product Output Capacity

EU27+3 Advanced Recycling Product Output Capacity

© nova-Institut

With advanced recycling a toolbox of versatile technologies is available to address plastic waste streams in different compositions and qualities in order to transform them into a range of different raw materials that can be reintroduced at different positions along the value chain of polymers and plastics. The technologies include material recycling based on dissolution (physical process) from which polymers can be obtained. Furthermore, numerous chemical recycling technologies are available that are capable to depolymerise a targeted polymer to its building units (monomers) via enzymolysis (biochemical process), solvolysis (chemical process), and thermal depolymerisation (thermochemical process). Another group of chemical recycling technologies are thermochemical processes which currently achieve the largest capacities. These technologies are based on pyrolysis, gasification and incineration coupled with Carbon Capture and Utilisation (CCU) which are capable to convert plastic waste into secondary valuable chemicals as well as naphtha, syngas, and CO2 which can be used as feedstock for the production of new polymers.

Overall, the report presents 127 advanced recycling technologies that currently are available on the market or will soon be. The majority of identified technologies are located in Europe including first and foremost the Netherlands and Germany, followed by North America, Rest of the World, China, Japan, CIS, Middle East & Africa. This report also features six pre- and post-processing technology providers which will play a key role in providing add-on solutions for feedstock pre-treatment prior advanced recycling as well as for the conversion of secondary valuable materials into chemicals, materials, and fuels.

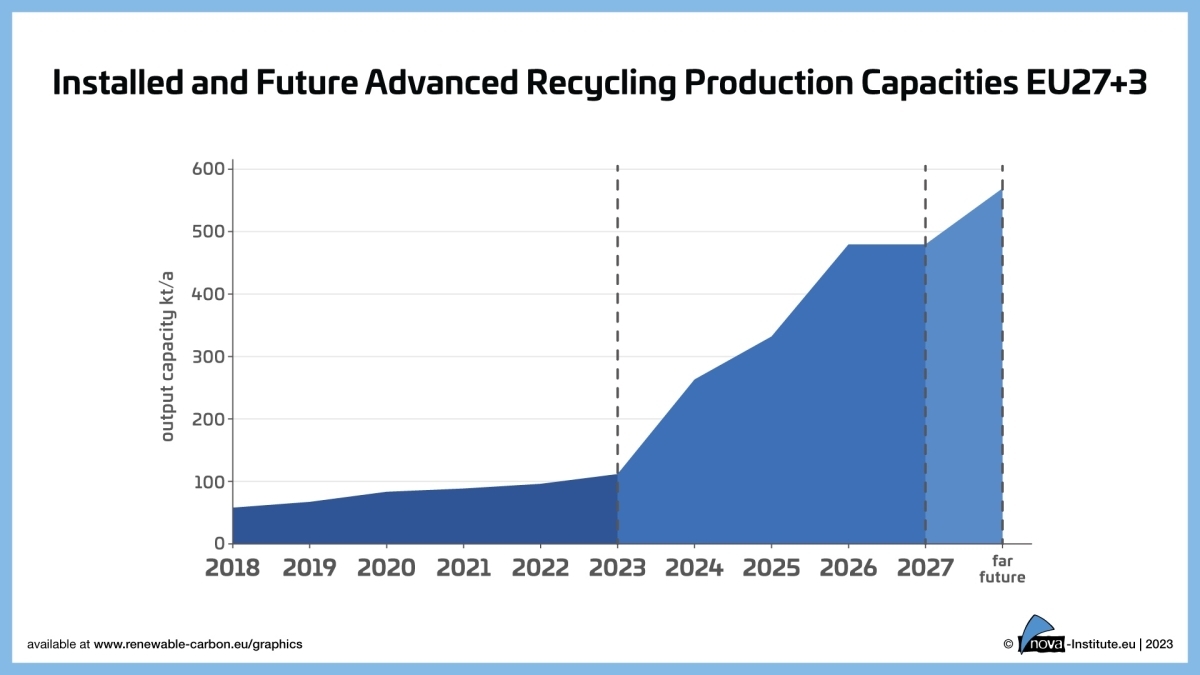

Installed and Future Advanced Recycling Production Capacities EU27+3

Installed and Future Advanced Recycling Production Capacities EU27+3

© nova-Institut

A detailed look into the technologies and their providers worldwide

The report “Mapping of advanced plastic waste recycling technologies and their global capacities” provides an in-depth insight into advanced recycling technologies and their providers. More than 100 technologies and their status are presented in detail listing the companies, their strategies and investment as well as cooperation partners. To ensure the highest quality of available market data, nova market studies built on top of latest insights from market experts, thorough research and a large number of individual interviews with industry players. The study covers different technologies in various scales including gasification, pyrolysis, solvolysis, dissolution, and enzymolysis. All technologies and corresponding companies which include start-ups, SMEs, and large enterprises are presented comprehensively. It further describes the technical details, the suitability of available technologies for specific polymers and waste fractions, as well as the implementation of already existing pilot, demonstration or even (semi-)commercial plants. Furthermore, the report systematically classifies and describes all recent developments including partnerships and joint ventures of the last years.

Dissolution

Dissolution describes a solvent-based technology that is based on physical processes. Targeted polymers from mixed plastic wastes can be dissolved in a suitable solvent while the chemical structure of the polymer remains intact. Other plastic components (e.g. additives, pigments, fillers, non-targeted polymers) remain undissolved and can be cleaned from the dissolved target polymer. Afterwards an anti-solvent is added to initiate the precipitation of the target polymer. The polymer can be obtained directly, in contrast to solvolysis, no polymerisation step is needed. Currently, the process reaches a maximum capacity of 8000 t/a whereby the majority of the nine identified technology providers is located in Europe (four providers), followed by North America (three providers), China (one provider), and the rest of the word (one provider). With three companies the majority of providers are small enterprises followed by micro/start-up- (two companies), medium- (two companies), and a large (two companies) enterprise which is represented by Shuye Environmental Technology (Shantou/China).

Enzymolysis

An alternative path represents enzymolysis, a technology based on biochemical processes utilising different kinds of biocatalysts to depolymerise a polymer into its building units. Being in an early development phase, this technology is available only at lab-scale. Currently, only one enzymolysis technology provider was identified which is a small enterprise located in Europe.

Solvolysis

The solvent-based solvolysis describes a chemical process based on depolymerisation which can be realised with different solvents. This process breaks down polymers (mainly PET) into their building units (e.g. monomers, dimers, oligomers). After breakdown, the building units need to be cleaned from the other plastic components (e.g. additives, pigments, fillers, non-targeted polymers). After cleaning, the building units are polymerised to synthesise new polymers. With 24 companies fewer solvolysis technology providers are on the market compared to pyrolysis also offering smaller capacities typically between 550-8750 t/a. Of the identified solvolysis technology providers a majority are located in Europe (14 providers) followed by North America (seven providers), Japan (two providers, and China (one provider). With nine companies the majority of providers are mainly small enterprises followed by large- (seven companies), medium- (five companies), and micro/start-up (two companies) enterprises. Among the large enterprises, there are Aquafil (Arco, Trentino/Italy, Eastman Chemical Company (Kingsport, TN/USA), IFP Energies Nouvelles (IFPEN) (Rueil-Malmaison/France), International Business Machines Corporation (IBM) (Armonk, NY/USA), DuPont Teijin Films (Tokyo/Japan), and Dow (Midland, MI/USA).

Pyrolysis

With pyrolysis, a thermochemical recycling process is available that converts or depolymerises mixed plastic wastes (mainly polyolefins) and biomass into liquids, solids, and gases in presence of heat and absence of oxygen. Obtained products range from for instance different fractions of liquids including oils, diesel, naphtha, and monomers as well as syngas, char, to waxes. Depending on the obtained products these can be utilised as renewable feedstocks for the production of new polymers. With 40 000 t/a, the second-largest capacity found in the report is realised with pyrolysis. The majority of the 80 identified technology providers are located in Europe (42 providers) followed by North America (21 providers), Rest of the world (11 providers), China (four providers), Cis (one provider), and Japan (one provider). With 27 companies most providers are small enterprises followed by micro/start-up- and medium- enterprises (both each 18 companies), and large enterprises (16 providers) such as Blue Alp (Eindhoven/the Netherlands), Demont (Millesimo/Italy), INEOS Styrolution (Frankfurt/Germany), Neste (Espoo/Finland), Österreichische Mineralölverwaltung (OMV) (Vienna/Austria), Repsol (Madrid/Spain), Unipetrol (Prague/Czechia), VTT (Espoo/Finland), and Chevron Phillips (The Woodlands, TX/USA).

Gasification

Another thermochemical process that is capable to convert mixed plastics waste and biomass in presence of heat and oxygen into syngas and CO2 is gasification. Overall, 12 gasification technology providers were identified and currently the largest achieved capacity measure up to 200000 t/a with most providers located in North America (seven providers) followed by Europe (five providers). The majority of the identified companies are medium sized (four companies) enterprises, followed by small- (three companies), micro/start-up (two companies), and large enterprises (one company). Eastman was the only identified large enterprise.

Evaluation of global capacities and the role of advanced recycling in Europe

More than 340 planned as well as installed and operating plants were mapped worldwide providing a total input capacity of 1477 kt/a. In Europe, there is already a considerable potential of know-how and providers for chemical and physical recycling technologies which is reflected in the comparison with the globally installed plants and capacities. From all installed chemical and physical recycling plants worldwide more than 60 and therewith the majority is operating in Europe covering nearly one quarter of the worldwide input capacity which ranks Europe at the top of the global comparison. Globally, the production capacity of advanced recycling is 1082 kt/a with products ranging from polymers, monomers, naphtha, Secondary Valuable Chemicals (SVC), and fuels & energy. Europe’s circular strategy becomes evident by setting the product shares of polymers, monomers, naphtha, and SVC from chemical and physical recycling into the global context. Here, Europe is capable to cover 36 % of the installed global capacity.

In the coming five years a strong growth of the market is expected in which the amount of installed chemical and physical recycling plants will steadily grow. A first indicator are the announcements of the technology providers for the construction of new plants. An analysis of these announcements shows that the input capacity in Europe 2027 will more than triple by 2027 while globally the capacity will double. However, the projection for Europe might change in dependence of additional political measures, a such as the revision of relevant directives or the establishment of incentives and investment programs.

You can access the full report here