IDTechEx asks if recycling can alleviate Li-ion metal supply concerns

11.03.2022Two major drivers of the Li-ion battery recycling market include the increasing demand for battery metals and the motivation to reduce the reliance on unsustainable and unethical mining practices. Recycling batteries alleviates both factors – but to what extent?

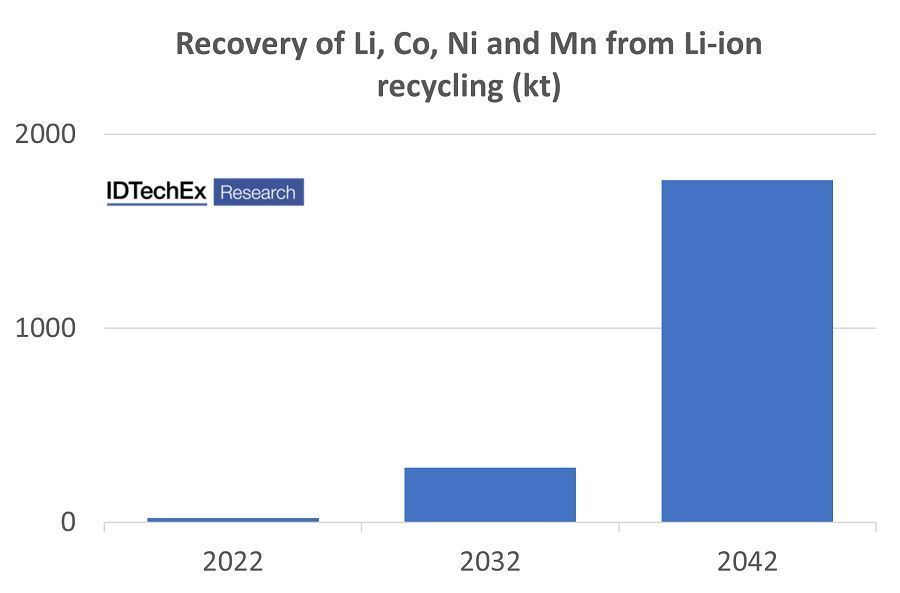

Forecast recovery of lithium, cobalt, nickel, and manganese from the recycling of end-of-life Li-ion batteries and manufacturing scrap. Source: IDTechEx – “Li-ion Battery Recycling Market 2022-2042”

Forecast recovery of lithium, cobalt, nickel, and manganese from the recycling of end-of-life Li-ion batteries and manufacturing scrap. Source: IDTechEx – “Li-ion Battery Recycling Market 2022-2042”

Human rights abuses such as child labor exploitation and hazardous working conditions have been reported in cobalt mines in the Democratic Republic of Congo, where over 70 % of the world’s cobalt mining occurs. Reducing the reliance on these mines for battery metals could help minimize cobalt supplied from unethical sources. While IDTechEx forecast that < 8 % of cobalt demand, and < 6 % of lithium, will be supplied by recycled Li-ion batteries by 2030, a higher percentage could be available. This is especially true for cobalt given its use in consumer electronics, where growth in demand is expected to be much slower than in EVs, and the reduction of cobalt intensity in electric vehicle batteries. In theory, approximately 15 % of cobalt demand could be met from recycled material by 2030. In reality, as outlined in IDTechEx’s forecasts, this is unlikely to happen due to the difficulty in collecting and diverting the high cobalt batteries from consumer electronics. Ultimately, all supply chain stakeholders need to take responsibility for the ethical impacts of their products.

Dr. Alex Holland, Author of the IDTechEx report

Dr. Alex Holland, Author of the IDTechEx report

© IDTech

Nevertheless, the inherent value in consumer electronics batteries suggests more comprehensive collection and distribution to the relevant recycling facilities needs to be considered. This argument can be furthered when considering the increasing possibility of material supply bottlenecks. IDTechEx estimates that cobalt shortages could arise from the mid-late 2020s, with bottlenecks also expected to arise for lithium, and possibly other materials as well. As a result, Li-ion recycling takes on added importance. While it will not be able to meet forecast material demand in the near future, it could play a role in minimizing material shortages and bottlenecks, which would disrupt the transition to electric vehicles, the deployment of stationary energy storage, and depress the market for Li-ion batteries.

End-of-life batteries from electric vehicles (including cars, trucks, 2-wheelers, and buses), consumer electronics, stationary storage, as well as battery manufacturing scrap, were examined to gain a clear view of the potential metal recovery recycling is expected to provide. IDTechEx forecast that a combined total of over 180 000 tonnes of lithium, cobalt, nickel, and manganese could be recovered by 2030 through Li-ion recycling, a value which is forecast to grow by approximately 10 x by 2042. Recycling will not be a silver bullet and fix all the challenges faced by the Li-ion industry, but it can help the shift toward a circular economy and will play an important role in minimizing material shortages and the negative impacts of Li-ion battery production. For more information on the state of the Li-ion recycling market, please see the IDTechEx report “Li-ion Battery Recycling Market 2022-2042”.